Investors gain new perspectives on industrial energy efficiency in Brazil

In May, the Industrial Energy Accelerator kicked-off the first of three energy efficiency workshops aiming to change perceptions among investors.

Improving the competitiveness of Brazil’s industrial sector, which contributes to 20 per cent of the country’s GDP, requires significant investment into energy efficiency. Even so, accessing finance to accelerate this industrial revolution is a significant challenge.

Currently, Brazil has very few companies and individuals with industrial energy efficiency expertise. Many of these service providers also lack the capacity to develop bankable proposals and meet the high collateral and creditworthy requirements of commercial investors.

From the investor’s perspective, there is a general lack of awareness of the commercial benefits of best practices in energy efficiency. Other challenges include bureaucracy, a lack of appraisal capacity among bank staff and the ‘high-risk’ perceptions surrounding energy efficiency projects.

“We know the potential positive impact of energy efficiency to the environment and on society. But in order to access finance, these arguments need to be bolstered with the financial potential,” explained Guilherme Teixeira of SITAWI.

Throughout the workshop, participants were presented a range of models and scenarios which showcased the energy efficiency business case. This included cash flow savings models; average payback periods for industrial energy efficiency measures; and examples of successful energy efficiency projects in other countries.

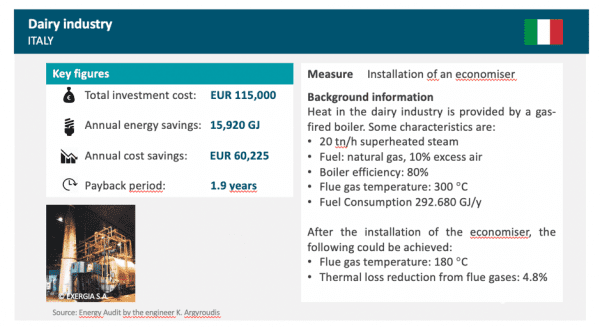

A case study from Italy’s dairy industry highlights the huge annual cost savings thanks to the installation of a boiler economiser. This piece of technology enabled residual heat capture. In less than two years the initial investment was recouped through energy efficiency savings.

In a country where industry accounts for one third of total energy consumption, Brazil’s industrial sector offers vast potential to reduce its energy use and associated costs. According to the Government’s 10-year-energy plan, nearly half of Brazil’s energy savings could come from industry.

Aside from the huge cost benefits, such a significant reduction in industrial energy use would help to limit greenhouse gas emissions. Process improvements implemented through industrial energy efficiency measures can also help to conserve water.

Vast opportunities for social impact can also be realised in small-to-medium enterprises, which provide livelihoods to 16 per cent of the Brazilian workforce.

“When we talk about industrial energy efficiency, we are talking about sustainability and the opportunity to improve productivity in Brazil,” said a participating representative from the Brazilian Development Association (ABDE).

“These workshops with the finance sector are very important opportunities to mobilize capital and leverage the potential of energy efficiency,” added the ABDE representative.

In addition to highlighting the various ways energy efficiency projects offer value, the workshop delved into strategies to adequately assess and mitigate investment risks. Recommendations included considering blended finance models and using energy efficiency cost savings as collateral.

Ultimately, the Accelerator’s workshop series aims is to provide bank staff with the tools and knowhow needed to confidently appraise energy efficiency investment projects from a risk management perspective.

However, engaging the finance sector alone won’t be enough to truly realize Brazil’s industrial energy efficiency potential. “A systemic approach is needed,” says João Lampreia, Senior Manager of the Carbon Trust in Brazil.

“There’s a very complex array of intertwined barriers and therefore a very complex set of potential solutions,” explained João, whose team co-led the analysis and design of energy efficiency initiatives for the Brazilian Industrial Energy Accelerator.

“It’s important to keep in mind that for each barrier, there isn’t just one solution, but a set of solutions that need to be deployed simultaneously.”

Participating banks: AgeRio Badesc Badesul Banco do Nordeste Bandes BDMG BNDES BRDE CAIXA Desenvolve MT Desenvolve SP FINEP Sicredi